The total modern office stock currently adds up to 4,426,050 sqm, consisting of 3,548,815 sqm of ‘A’ and ‘B’ category speculative office space as well as 877,235 sqm of owner-occupied office space. Within the speculative stock, Class ‘A’ office space accounts for 67%, while Class ‘B’ office space represents 33%.

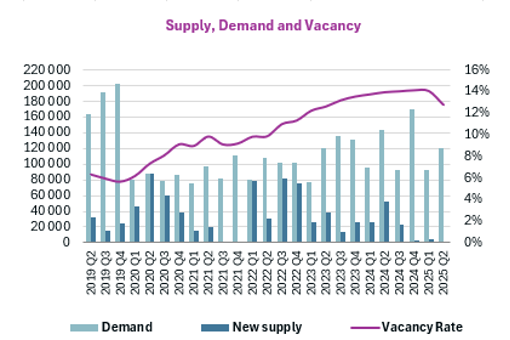

No new modern office space was delivered to the Budapest market in Q2 2025, thereforeso the total stock remained unchanged compared to the previous quarter.

During the second quarter, 22,935 sqm of speculative office space was transferred from the speculative stock, increasing the owner-occupied office stock to 877,235 sqm.

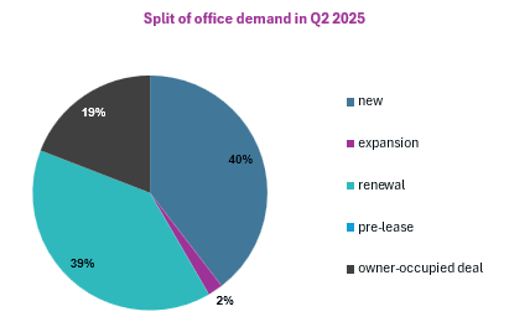

Total demand amounted to 119,975 sqm in Q2 2025, reflecting a 16% decrease year-on-year. Renewals took up 39% of the total demand. New leases accounted for 40%, while expansions made up only 2%, and owner-occupier deals represented 19%. No pre-lease agreements were recorded during the quarter.

Net take-up (excl. renewals and owner-occupied transactions) reached 49,955 sqm in the examined period, indicating a 21% decrease compared to the second quarter of 2024.

In Q2 2025, the office vacancy rate showed 12.8%, reflecting a 1.29 percentage point decrease compared to the previous quarter and a 1.18 percentage point decrease year-on-year. The lowest vacancy was registered in Central Buda with a vacancy rate of 7.4%, whereas the highest vacancy rate remained in the Periphery submarket (19.4%).

Net absorption turned positive and amounted to 57,000 sqm.

The strongest occupational activity was recorded on the Váci Corridor submarket, attracting 37% of the total demand, and it was followed by South Buda submarket, which took up 22% of the total demand in Q2 2025.

According to BRF, 136 lease agreements were concluded in Q2 2025 and the average deal size amounted to 882 sqm, reflecting a decline in the number of transactions compared to the same period last year, while the average deal size remained almost unchanged. The largest speculative transaction of the quarter was a lease renewal, for 13,800 sqm on the Váci Corridor submarket. The largest new lease was signed for 12,500 sqm, also in the Váci Corridor.