The respective growth, and real acceleration for energy dependent cities, is part of a global shift towards energy demand moving away from OECD (Organisation for Economic Co-operation and Development) to non-OECD countries3. Emerging markets, particularly China, India and parts of Africa and the Middle East, are leading such demand.

In addition, global energy consumption has risen by 2.3% this year, with 80% of the increase attributed to non-OECD countries. China, for example, is expected to become the world’s largest oil importer and India is set to become the largest coal importer.

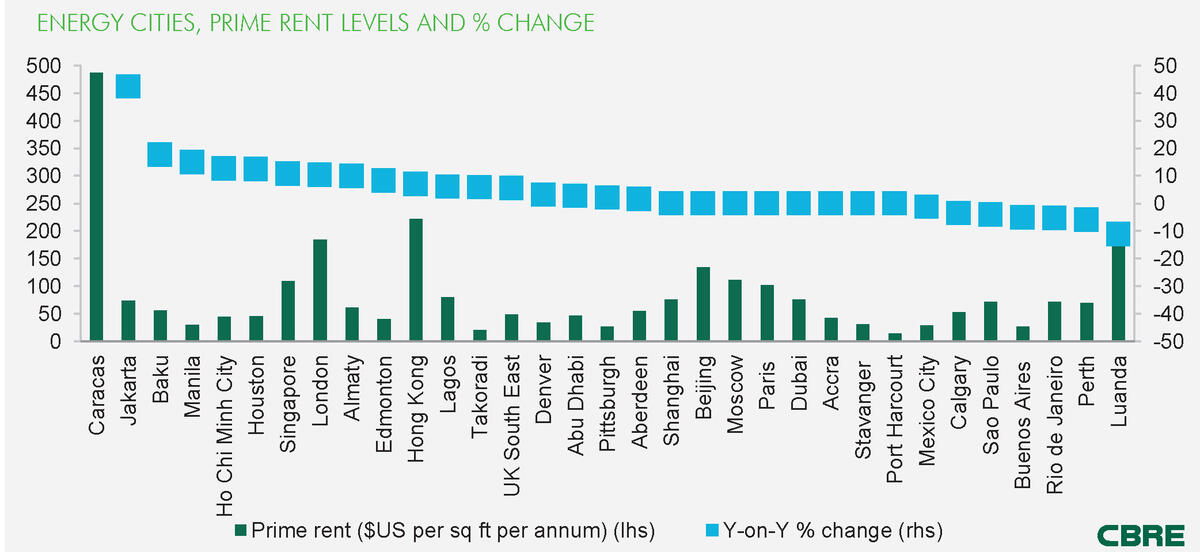

Such acceleration of energy production in non-OECD countries has led to steep increases in demand for good quality office space. Cities like Caracas, Jakarta and Baku are among the locations experiencing increased demand from energy companies which is forcing rental values up due to a lack of available good quality office stock. Caracas, Venezuela a city heavily invested in the energy sector, has seen prime office rents increase by 280% y-o-y, although this is also influenced by limited office development, high inflation and uncertain political conditions; Jakarta, Indonesia has increased by 42% while Baku, the energy focused capital of Azerbaijan, has picked up by 17.6%.

Luanda, the capital of Angola, is the second biggest oil producer in sub-Saharan Africa with energy sector occupiers accounting for a substantial portion of the market. Although rents have eased slightly over the past year, low supply and ongoing demand mean that the prime rent is $178 per sq ft pa, ranks it fourth of the cities surveyed. For comparison’s sake: in Budapest, Hungary, quality offices are available already for one-tenth of this price.

“Energy markets continue to evolve at a rapid pace and the landscape is expected to undergo fundamental and lasting changes over the next 20 years. Energy supply is coming from a greater range of locations with such diversification effecting companies’ operational decisions and causing substantial impact on office markets. This is particularly the case in some emerging markets where there is limited office stock and high demand for space from energy sector companies. A year ago, on average energy dependent cities were up by 10.6% y-o-y compared to established business centres at 2.9%. The jump in growth to 25% signifies the upward rental trend of energy dependent markets”, Michael Armstrong, Director, EMEA Global Corporate Services, at CBRE, commented.

CBRE