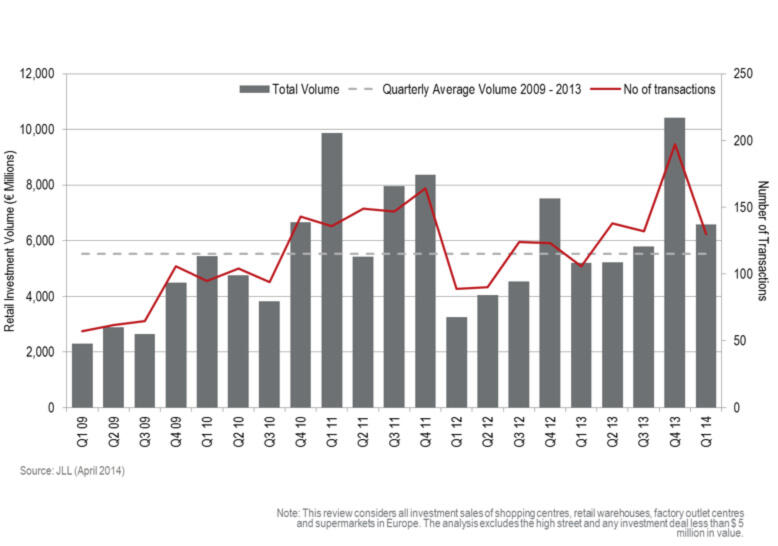

Direct investment in retail real estate for Q1 reached €6.6bn, up 27% from the Q1 2013 volume of €5.2bn, and 20% above the five year quarterly average.

Geographically, the majority of activity remains focused on the large, liquid markets of the UK and Germany, which together accounted for 63% of total volumes. The UK market remains buoyant with Q1 volumes of €2.3bn, 27% above the five-year quarterly average, while in Germany, several major deals boosted volumes to €1.8bn, 56% above the five-year quarterly average. Elsewhere, there has been a significant increase in activity in the recovery markets of Italy, Spain and Ireland, in addition to the Netherlands, which indicates the continuing broadening of investor appetite for geographical expansion.

James Brown, Head of European Retail Research and Consulting, concluded:

“The ‘mega deals’ that we are witnessing both in the UK and Europe, at keen yields, demonstrate the ongoing attractiveness of prime shopping centres to investors, and also reflect the strengthening demand from national, and particularly international retailers, for space within the best dominant, regional centres across Europe. Looking forward, given improved economic sentiment, a continued increase in the weight of capital and the broadening of investment targets both in terms of geography and typology of assets, we expect to see an increase in 2014 volumes on the €26.6bn in 2013. The potential dampener on this momentum remains the availability of prime stock, which may not keep up with this demand.”

Rita Tuza, Head of Research at JLL Hungary, added: The trend is very similar in Hungary, as we experience a significantly higher interest for retail assets than in previous years. Only retail assets were transacted during Q1 2014 in a value exceeding €50 million, reflecting a massive 24% increase on the 2013 annual volumes. Based on our expectations, capital markets will be dominated by the retail sector in the second quarter further on. We believe that investment in retail assets will potentially reach its highest volume of the past 3 years in 2014. “

JLL