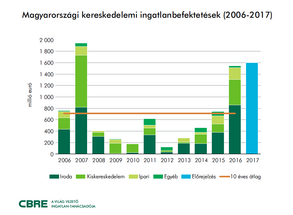

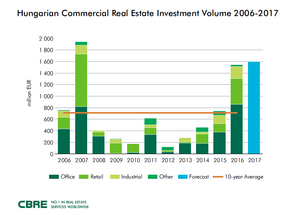

Commercial properties changed hands in the amount of EUR 745 million in 2015 in Hungary, and in 2016 the turnover was more than double, EUR 1.54 billion. The growth in the office market was 129 per cent, which is explained by the demand for the increasingly attractive second and third class properties appearing in the market in addition to the modern office buildings. The investment turnover of retail properties increased by an even more significant 203 per cent, due in part to the change of ownership at the major Mammut shopping centre. The 44 per cent growth of the industrial property market falls short of the other two sub-markets because of limited supply, as currently there are only a few industrial and logistics properties for sale in Hungary.

The development of the Hungarian real estate market shows also in the decrease of the average transaction size, which is now lower than it was before the crisis; the liquidity of the lower segment has significantly improved, which means that not only large properties are in demand: local investment funds and individual investors are showing a strong interest in EUR 50-60 million properties. Demand is lower for EUR 60-100 million properties, however there is a considerable demand for properties over EUR 100 million, especially from large international institutional investors; but supply is limited, essentially there are only shopping centres in this segment.

"We are expecting a strong turnover in the Hungarian commercial property market also for 2017. The stable economic growth and the increasing household consumption make the country attractive for investors, and moreover, all three credit rating agencies graded Hungary "suitable for investment”, thus more institutional investors may enter the market. The investment sales have quadrupled since 2013 in Hungary. This extraordinary growth has positively affected also the advisors; the market grew by an annual 20 per cent in the last three years. CBRE has managed to grow in this period at a rate of 40 per cent per year, which was only possible through the trust and confidence of our customers and our strategic cooperation with them”, Lóránt Kibédi-Varga, Managing Director of CBRE Hungary said.

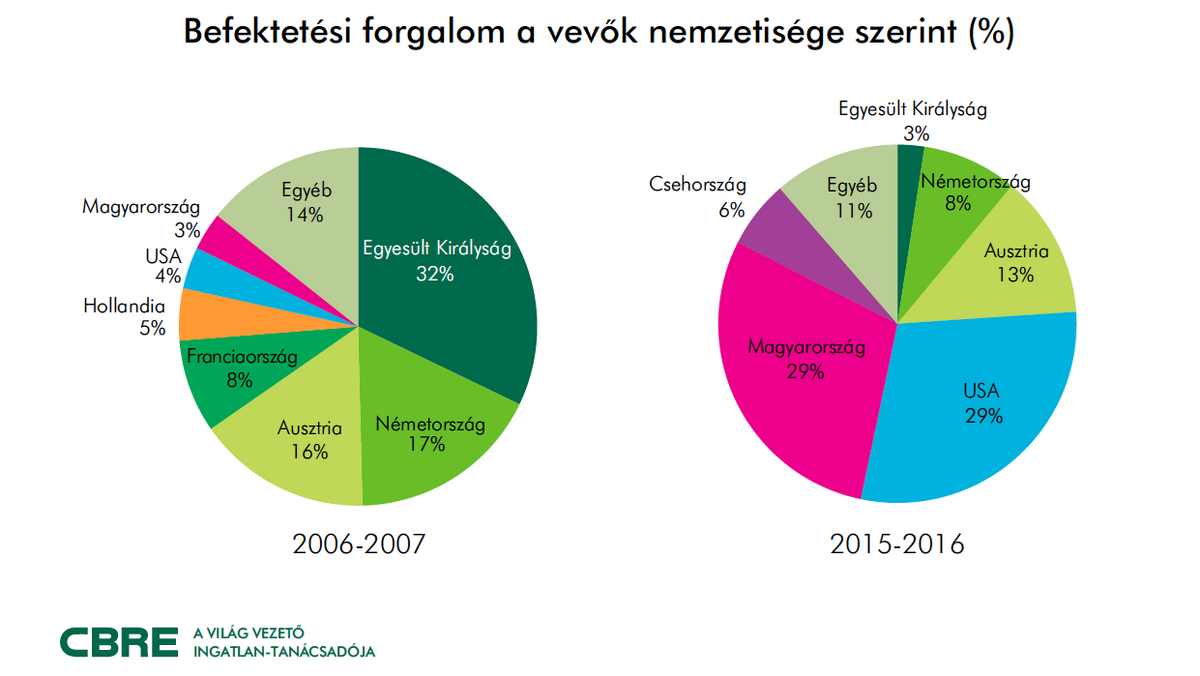

"Besides the usual Western European investors and the Hungarian and American institutional funds new actors have also appeared in the market, ie Greek and investment companies of Unites Arab Emirates and also the German closed-end funds have returned to Hungary, which all played a role in the turnover growth in 2016. German funds bought benchmark office buildings Park Atrium and Eiffel Square in Budapest. In addition to the latter the acquisition of Váci Corner was the third significant transaction in the Budapest office market last year. We can truly state that Hungary is back on the investment map. Our team had a successful 2016 with involvement in some landmark deals and the pipeline looks solid heading forward. With new equity and solid fundamentals I expect 2017 to be another record year for the Hungarian investment market”, Tim O’Sullivan, Head of Capital Markets at CBRE added.

CBRE