After years of flat volumes, France saw a significant increase in investment turnover s in Q2 2014, double the level seen in Q2 2013. The increase in H1 2014 was largely due to a small number of large lot size deals and the historically low cost of money coupled with rents at the bottom of the cycle.

In the UK, investors continued to be more active outside of Central London. Approximately 60% of total investment in the UK occurred outside the capital. This included ten transactions from Asian and Middle Eastern investors, one of which was for more than €200 million. Non-European capital has increasingly been spreading into regional UK – in line with CBRE’s prediction earlier this year about capital flowing more into the secondary markets as an outcome of yield compression in London.

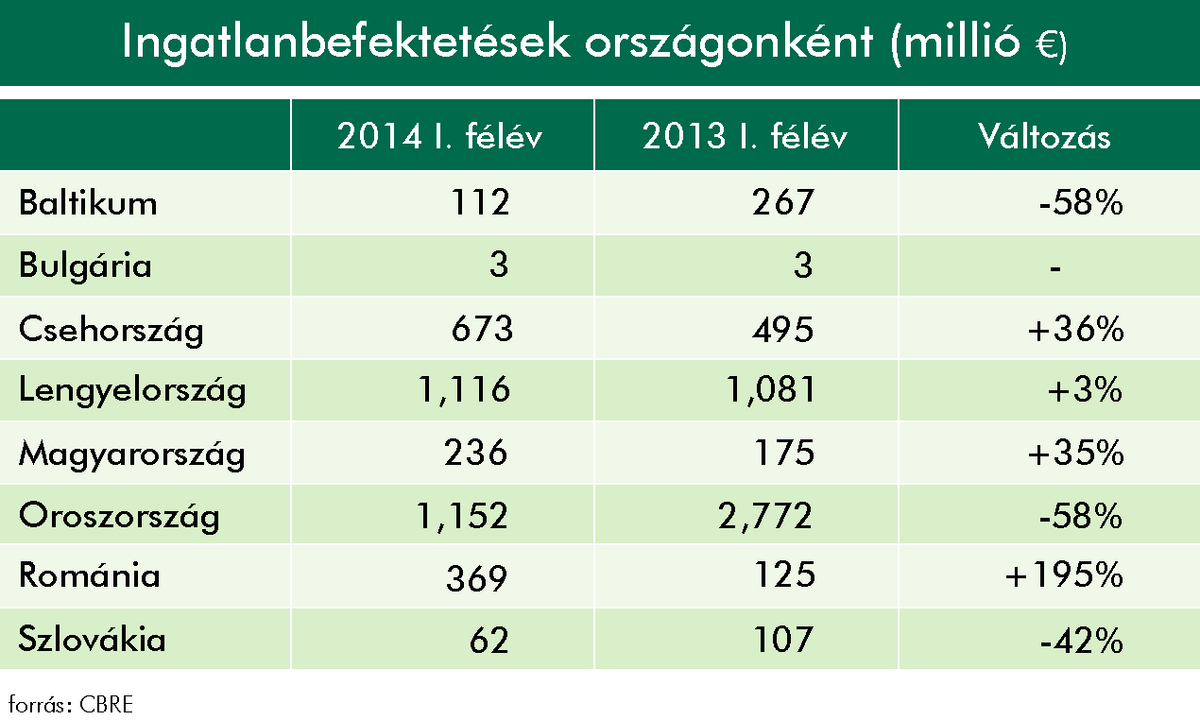

Romania saw the greatest rise in commercial property investment volumes with close to 300% increase year-on-year, however, coming from low levels of activity. This can be explained by continued low interest rates, increasing allocation of institutional investors to real estate, relatively high yields and the belief that economic growth should be solid in the coming years.

The Czech Republic and Hungary also saw significant increases in investment volumes with uplifts of 36% and 35% respectively. These two countries in particular have benefitted from the challenge that many investors have had in finding the product they are looking for in Poland. This lack of supply has had a positive impact on neighbouring countries, which also can offer more attractive yields in the current market.

Despite these increases, Russia and Poland continue to dominate commercial property investment in the region. Together they account for over 60% of the investment volume at €1.2 billion and €1.1 billion respectively. Poland’s real estate market continues to attract strong investment and the Polish economy - after a slight dip in recent quarters - is moving back into growth mode. Poland has moved away from being a niche market and continues to mature into one of the core investment locations in Europe. Russia, however, saw investment flows fall almost 60% over the first six months of the year. This is largely due to the well-publicised tensions with the Ukraine, but also reflects the irregularly high transaction activity in Q1 2013.

“As predicted, we saw investment volumes increase already in H1 2014 and we are already close to exceed last year’s annual level. In the fist half of the year over 230 M EUR turnover was registered as speculative investment volume and other 50M EUR trade of vacant / owner occupied properties was added on top of that. This is still far below the level we see in Czech or Poland but clearly indicates a rising trend, reflecting a better sentiment about Hungarian property investment market”, Gábor Borbély Head of Research and Consulting at CBRE Budapest commented.

CBRE