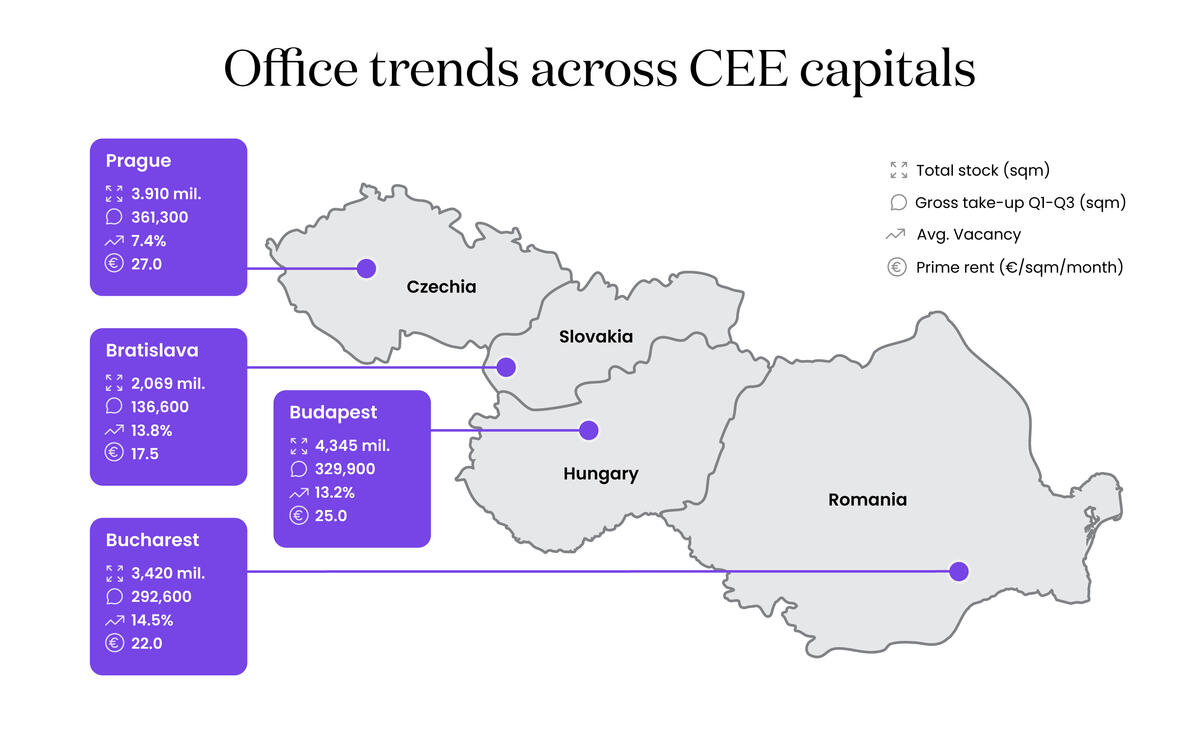

The total YTD demand dropped by 14% year-on-year, and renegotiations accounted for 46.5%. The vacancy rate is standing at 13.2% in Budapest at the end of Q3. In terms of prime rent, Budapest has the second highest prime rents across the region.

Milan Kilík, Head of Office Agency in Prague, Czech Republic: “We can see a lot of differences in the local markets. While some landlords are benefitting from a modern project at most wanted locations and use the indexation to their benefits, the others with older buildings and distant locations are struggling with attracting and retaining tenants and have to incentives at a higher cost to increase the interest in their building. Tenants in distant areas are price-sensitive, impacting demand and raising concerns about vacancies. With limited stock to be delivered to the market in the upcoming year it is most probable that the rents will not be lower but climb to even higher levels from what we see today. The tenants who will act now and have a good representative will thus benefit from the situation.”

If we look at the CEE market more closely, year-on-year, there was a decrease in Q3 gross take-up in Prague (by 34%) and Bratislava (by 23%), whereas it rose in Budapest (by 34.2%) and Bucharest (by 95%). A higher level of renegotiations is happening across the region. To some extent it is a cyclical development as the contracts from strong take-up in previous years come to an end, which was the case in Bucharest and Budapest. Moreover, the combination of high relocation expenses and costly fit outs is compelling tenants to renegotiate their agreements within their current spaces more frequently, as experienced on the Prague market.

All four markets featuring modern office real estate experienced a year-on-year increase in vacancy rates, with Prague showing the lowest vacancy rate (7.4%), while Bucharest had the highest percentage of unoccupied offices at 14.5%. The vacancy rate in Bratislava and Budapest surpassed 13% in the third quarter of 2023.

Elevated construction costs and the unfavorable economic situation in Europe are impacting the future development of new offices across much of the region. More precisely, in Prague and Bratislava in 2025, there's an anticipation of insufficient availability of new office space, with Prague office market witnessing no new office development launch in the last 15 months. This might result in demand overweighting the supply situation, leading to upward pressure on rental prices and heightened competition among tenants.

In Bratislava, the saturated office market is another factor that is influencing development pipeline. Based on the latest figures there is no new office building to be delivered in 2024 and for 2025 currently there is to date only 10,000 sqm under construction. In the years 2026 and 2027, the supply will begin to approach the 10-year average, which is at 60,000 sqm. Relatively weak pipeline will benefit newly completed offices, which currently have higher vacancy rates.

In Bucharest, low net take-up, subleases due to hybrid work adjustments and high vacancy rates are the main factors constraining new construction. Other factors valid across CEE include expensive construction, high interest rates, and overall economic uncertainty.

A deviation from this prevailing trend is observed in the Budapest office market, where there is presently an ongoing construction of nearly 280,000 sqm scheduled for completion by 2026. Notably, 170,000 sqm of this space is slated for delivery in 2024. It is crucial to acknowledge that, despite the heightened construction activity in Budapest surpassing that of Prague, Slovakia, and Bucharest, there is an overall downward trajectory in construction activity in Budapest. Since 2019, Budapest has consistently maintained the highest volume of buildings under construction in the region. Similar to Prague, Bratislava, and Bucharest, Budapest is also experiencing a decline in development activity. However, due to the elevated base of the pipeline, the present volume in Budapest remains comparatively higher. Nevertheless, it is reassuring to note that over 40% of the projected 2024 pipeline is already pre-leased. This provides confidence that the vacancy rate is not likely to escalate rapidly in Budapest.

Blanka Vačkova, Head of Research, Czech Republic, concluded: “CEE office markets are currently facing a problem of slowing net demand which is stemming from higher rental and fit-out costs, adjustments to hybrid work and overall economic uncertainty. Another challenge is postponing new construction. Even though the CEE markets have registered an increase in office rents over the last years, high cost of finance and construction, combined with rising yields deteriorated economic side of the project to the extent that it is not feasible to commence a construction of new offices. High vacancy rate, which stands in three CEE capitals except for Prague above 13%, is another factor adding to the overall caution. The only market that is moving in a different cycle in terms of development is Budapest registering robust construction activity. In Prague, Bratislava, Bucharest or Warsaw, the current levels of development are very much below pre-Covid years. Specifically in Prague, we can expect a lack of new modern offices in the upcoming years.”

iO Partners