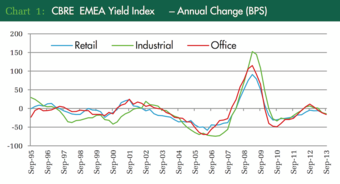

Over Q3 2013, CBRE’s EMEA Prime Yield Indices edged lower in the office, retail and industrial sectors by between three and five basis points. Of the three sectors, the office market showed the most widespread movements, with yields moving lower in nearly a quarter of the locations surveyed including Amsterdam, Dublin and all the major UK regional cities.

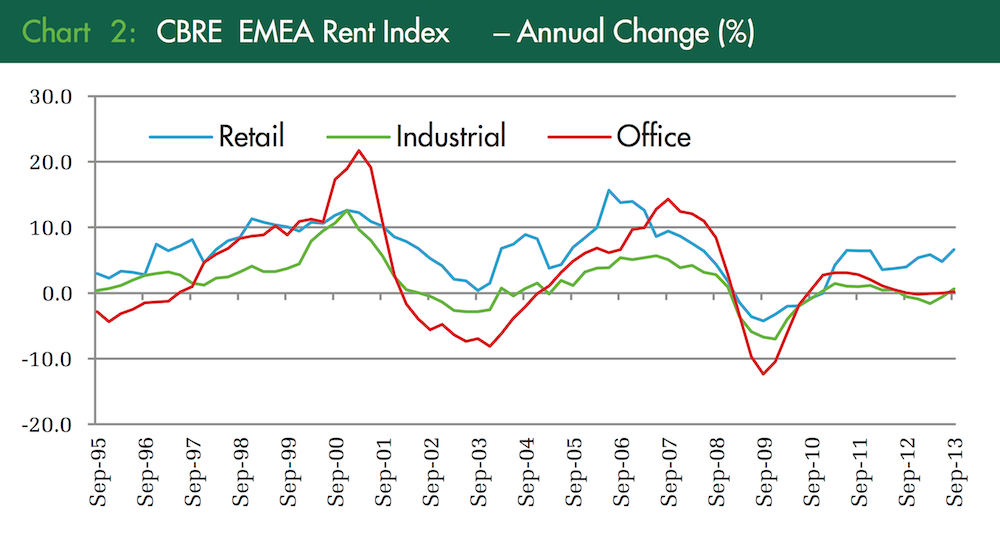

Rental improvement was most evident in the prime retail market, where nearly a quarter of the locations surveyed saw an increase, twice as many as declined. The increases encompassed some of the most prestigious retail locations in Europe, with rental increases recorded in Paris, London and Milan, as well as further afield in Istanbul and Dubai.

Rental momentum is less evident in the office market, where almost as many locations fell as rose. Downward pressure continued in parts of southern Europe including Rome and Madrid. Most of the increases occurred in smaller markets, although Munich edged up and prime rents in the West End of London hit £100 per sq ft.

Gábor Borbély, Associate Director, Head of Research in Budapest, said: “On average, prime yields have fallen by around 15 basis points across all sectors over this period. Yield compression was more significant in core Western markets; however, it happened across CEE as well on a more selective basis. Budapest yields are flat on last year’s level which results in a widening yield gap compared to core markets. Stable rental levels and re-emerging pricing advantage make Budapest again a lucrative target in the eyes of many investors.”

CBRE