Commercial real estate investment in Central and Eastern Europe slowed in H1 2015 due to a lack of available prime stock and the impact of rent contraction in Warsaw’s office market, the region’s most liquid market.

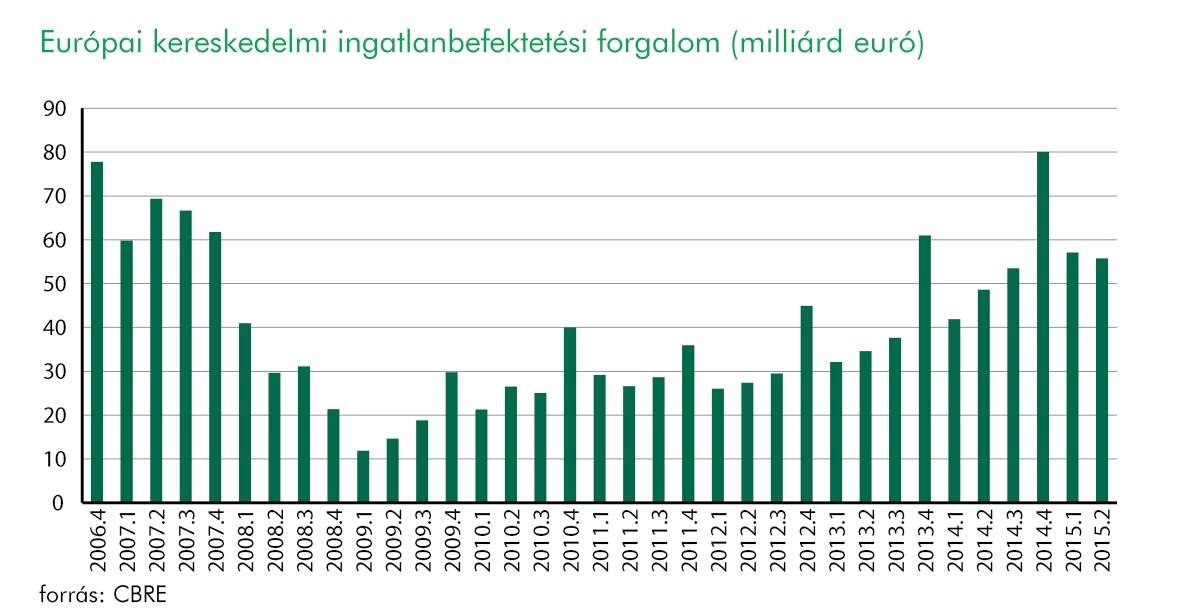

Spain, Portugal, Finland and Norway experienced an exceptional increase in investment levels, each more than doubling on Q2 2014. Germany also had a strong quarter with investment of €12 billion, up 62% on Q2 2014. Investment turnover in the UK was up 10% on Q2 2014 when measured in euro, but this increase was almost entirely due to the exchange rate shift; in sterling the total was virtually unchanged from Q2 2014.

“Investment has increased steadily this quarter, with a strong overall picture for European markets. Not only are the recovery markets of Spain and Portugal experiencing high levels of investment, but the more established countries such as Germany also had strong quarters. In recent months we have seen the market trying to balance a lack of stock with the large amount of capital available for investment. This has generated a significant amount of activity in the portfolio sector, and in Q2 we again saw an increase in corporate deals such as Merlin Properties’ recent acquisition of Spanish property company Testa for around €1.8 billion”, Jonathan Hull, Managing Director, EMEA Capital Markets at CBRE, commented.

CEE: limited availability of prime assets

Retail is in high demand throughout CEE, particularly prime stock. Large scale shopping centres in the major cities across Central Europe are most sought after, however are often difficult to get hold of. Palladium, the largest single asset deal ever recorded in the Czech Republic, pushed up retail investment levels and illustrated that large deals can have a strong positive knock on effect on volumes. Alongside retail, investors are showing significant interest in the industrial and hotel markets, this coupled with the positive economic conditions, should lead to a strong performance in the second half of the year.

“The limited availability of prime assets and the impact of office construction activity in Warsaw, CEE’s most liquid market, weighed on investment totals in H1 2015. While we continue to see strong international demand for assets in all sectors, leading to a strong pipeline of deals that could close in H2 2015. Attitudes to non-core locations in the CEE are likely to feel the pinch as a result of the turn in sentiment in Greece which is likely to result in less deal-flow in those markets in H2 2015”, Jos Tromp, Head of Research and Consulting, CEE and Africa, commented.

Hungary: Uncertainties surrounding the Greek crisis postponed transactions

“The Hungarian real estate investment market produced a nearly € 300 million turnover in the first half of the year, of which income-producing assets changed hands in the value of 250 million Euros. This figure fell short of prior expectations because the closing of some transactions were postponed to the third quarter of the year. Besides seasonal reasons, the uncertainties surrounding the Greek crisis also played a role in the summer slowdown, as it prompted several investors to be generally cautious. At the same time, the second half of the year could be much stronger, the pending transactions alone can double the turnover. We will also see in early autumn what kind of larger transactions can close in the December investor spurt and by how much this year's sales can surpass last year’s 470 million turnover”, Gábor Borbély, Head of Research at CBRE Hungary added.

CBRE Hungary