The recent upsurge of migration into Germany will have a positive impact on retail sales growth at the national level and, in particular, on some of the large German cities where good employment prospects make them natural magnets for new migrants. The research highlights the potential hotspots of retail consumer demand with 14 German regions featured in CBRE’s top 60 ranking. CBRE’s research titled “How Active are Retailers in EMEA?” found that more major retailers are planning to expand in Germany than in any other European country (53% compared with 23% in the UK).

“Population is a key determinant of spending power in a demographically constrained but economically successful country like Germany. Higher population will mean more spending, pushing up the space needs of domestic retailers and making Germany a more attractive destination for international retailers.” - Neil Blake, Head of UK and EMEA Research at CBRE, commented.

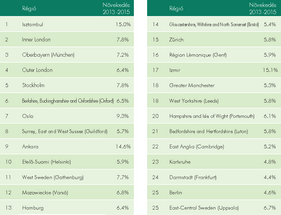

Turkey has become a key player in the European economy and this does not leave retail without impact. With seven regions listed in the top 60, Turkey has by far the most retail sales growth potential in Europe. Istanbul is also to benefit from a cumulative 15% growth from 2013 to 2015.

In CEE and South-Europe retail markets are expected to recover slowly in the next few years at much lower rates. On top of the economic slowdown, the migration to Western Europe has a negative impact on retail growth in particular in Greece and Bulgaria. In CEE the most attractive region is Warsaw - size of the market and stable economic growth ranks the Polish capital 12th in Europe. Budapest together with the other capitals in CEE is placed at the second half of the list.

“Due to its market size Budapest is placed ahead of neighbouring capitals like Prague, Bucharest and Bratislava. But economic stability, growth in incomes and spending will be necessary to bring Budapest and the other CEE capitals back into favour amongst retailers.” – Anita Csörgő Head of Retail at CBRE Hungary added.

CBRE